Its no news that FX market is probably one the of the hardest to "predict". Maybe that's why I like it most, so I can be wrong very often and use this excuse..."its hard". Seriously, "predict" is not the perfect word to use for most of the financial assets because its a impossible task and carries a burden of a exact value, as many expect it to be. Instead, what is possible is to access all important variables and estimate the likely path, the odds, levels and so on. Even so its nto easy, but we do it. We need to (at least to answer those friends and relatives that always ask "Should I buy USD now or later".

I like to compare the FX market with weather forecast - now weather seems to be a more exact science!!! We have longer term forecasts that has to do with cyclical factors like the 4 seasons. For the time horizon of weeks and months they measure pressure, currents, water temperature and many others to gauge what the weather will likely be in weeks to come. And finally nowadays for the daily weather and next few hours you can access a real time satellite and watch where the rain is and moving to. We can approach FX market in the same way: for short term of intraday and few weeks we have measures of positioning (speculative agents too long or too short), technical analyzes (no, not used like horoscope but accessing important market levels) and economic surprise indexes. For relatively longer term we have interest rates spreads and inflation. And finally for the long term things like purchase power parity, relative growth and unemployment.

With this approach in mind lets think a bit about the USD index (could be the DXY if you prefer)

starting with the very short term the signs are a bit mixed. Charts show USD not losing some momentum yet:

However when we look one of the positioning gauge, in this case COT for DXY (futures only), there is no big pressure for a stronger USD:

Im using the non commercial short position / total open contracts. Its low and turning

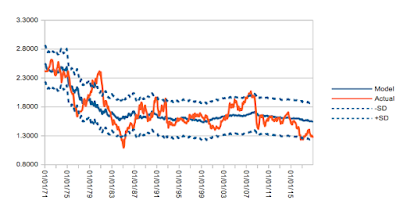

Now moving to the longer term. I Use some models trying to aggregate all medium to long term factors I discussed above. What it shows is that USD could be expensive relative to those currencies below that are heavy weighs on the index.

EURUSD

GBPUSD - two charts with different rate term spread

USDJPY

Putting all together I think USD are still holding but as soon as we have a more constructive short term trend and momentum we could see it very weak in the months or maybe year to come. Specially also if European economy recovers quickly in the few months ahead.

I like to compare the FX market with weather forecast - now weather seems to be a more exact science!!! We have longer term forecasts that has to do with cyclical factors like the 4 seasons. For the time horizon of weeks and months they measure pressure, currents, water temperature and many others to gauge what the weather will likely be in weeks to come. And finally nowadays for the daily weather and next few hours you can access a real time satellite and watch where the rain is and moving to. We can approach FX market in the same way: for short term of intraday and few weeks we have measures of positioning (speculative agents too long or too short), technical analyzes (no, not used like horoscope but accessing important market levels) and economic surprise indexes. For relatively longer term we have interest rates spreads and inflation. And finally for the long term things like purchase power parity, relative growth and unemployment.

With this approach in mind lets think a bit about the USD index (could be the DXY if you prefer)

starting with the very short term the signs are a bit mixed. Charts show USD not losing some momentum yet:

with exception of GBP maybe if we consider all the uncertainty around bexit

Im using the non commercial short position / total open contracts. Its low and turning

Now moving to the longer term. I Use some models trying to aggregate all medium to long term factors I discussed above. What it shows is that USD could be expensive relative to those currencies below that are heavy weighs on the index.

EURUSD

GBPUSD - two charts with different rate term spread

USDJPY

Putting all together I think USD are still holding but as soon as we have a more constructive short term trend and momentum we could see it very weak in the months or maybe year to come. Specially also if European economy recovers quickly in the few months ahead.

Comentários

Postar um comentário